Alexandru Stan

Jeudi 12 mars 2015 à 11h, salle 24-25/405

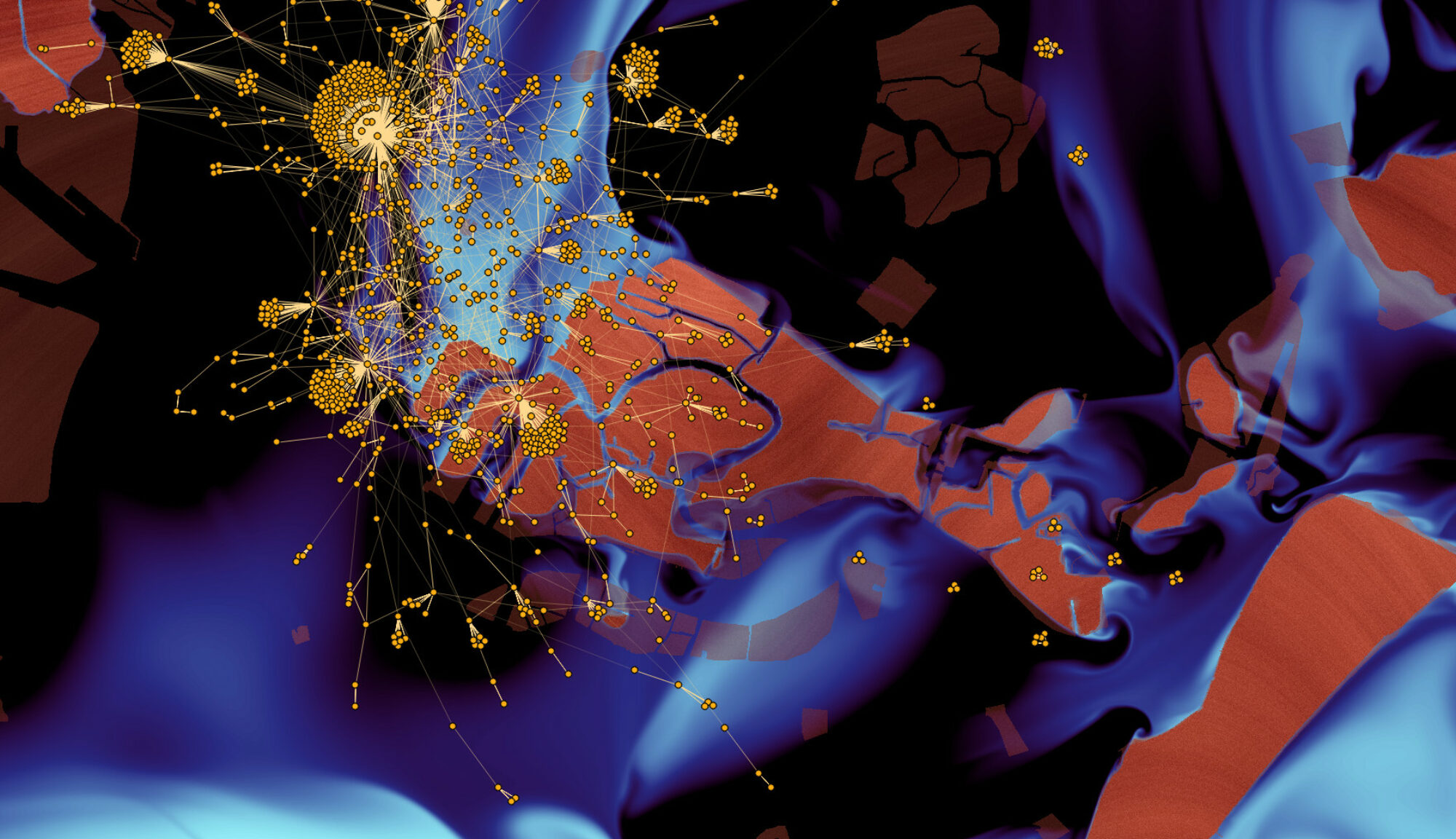

This presentation aims to shed some light into the dynamics of market flash crashes by presenting several volume time models for the price evolution of financial assets. The theoretical foundation of our modeling relies upon the hypothesis that the flash crash represents the immediate repercussion of growing levels of order flow toxicity, as informed traders adversely select uninformed traders and, progressively, force them out of the market. We model the unfolding of this hostile behavior through a classic stochastic prey-predator model which segregates market transactions into toxic and harmless. Assuming that the price is following an Ito-process, we show how to predict the flash crash conditions during the flash crash unfolding. We also notice structural breaks in the dynamics of the market topology.